Communications service providers (CSP) are surrounded by challenges from all directions, writes Robin Duke-Woolley, the chief executive of Beecham Research. Their central service offering has commoditised, growth is constrained by market saturation and they have no option but to invest billions in capex in the next generation of mobile technology. Against this unappealing background, they have to deliver great experiences or customers will walk.

CEO

Beecham Research

With the COVID-19 pandemic putting connectivity even more at the centre of peoples’ lives, CSPs are under intense pressure to operate more efficiently while addressing the shift in network usage from centralised offices to more geographically distributed home-workers. This opens up a vast arena in which much can go wrong. Wrongly configured home Wi-Fi, congestion caused by the voracious bandwidth consumption of locked down children and device and software issues can all look to customers as if they’re the networks’ fault. CSPs have to turn this losing game into a winning situation but efforts so far to utilise their data to transform their operations and customer satisfaction have not delivered the results they need.

CSPs have focused on their data but data alone isn’t the answer. It’s what is done with the data and how the insights within it are acted upon that has the power to transform the telecoms industry. CSPs have invested heavily in data infrastructure but have not closed the loop by completing their data strategies to encompass analytics, automation and the decision-making capabilities needed to provide services that increase customer satisfaction.

Increased customer satisfaction is the means by which they will compete with new market entrants, retain existing customers and carve out a larger share of the digital value chain. Research from analyst firm Analysys Mason has uncovered that for every 1% increase in net promoter score (NPS) there is a corresponding decrease in churn of 4%. Similar research from AT&T has shown that customers that have a customer satisfaction score of 90% or more typically spend US$10 more each month and remain as customers for longer than those with a score of 75%.

This sort of results rely on the cohesive utilisation of CSP data, as shown in Figure 1, to drive satisfaction and those that are successfully meeting customer expectations know in much greater depth the people who buy and use their products and services. This goes beyond standard segmentation criteria such as age, gender and income and brings together insights such as: What do they do with their time? What sort of places do they like to frequent? What do they think of other brands? What do they think of your brand?

Telecoms needs visibility

These insights are foundational business indicators in many market sectors but the telecoms industry, because of the intensity of the challenges it faces, needs this visibility even more than others. Tier 1 CSPs are now facing many challenges as their markets change and become ever-more disrupted by new entrants. Here are just a few of them:

a) Driving profitable growth in a saturated marketplace. Where are the growth opportunities? How to add new value?

b) Identifying and retaining valuable customers at risk. Who are they? What will attract them? What are the risks?

c) Managing the complexity of devices and equipment. How to keep up with rapid changes in new technologies to provide the support customers need?

d) Improving customer experience and satisfaction. How to plan for excellent customer experiences? What are they looking for?

e) Anticipating disruptive initiatives from new market entrants. How to be flexible and respond quickly to new market challenges?

Faced with these and many other challenges, CSPs are having to ask themselves how vulnerable they are to disruption and whether they are doing enough to stay ahead of competitive and market threats through reinvention and innovation. The answer to those questions is ‘no’ and they have been and continue to be overtaken by new entrants from other sectors.

Many Tier 1 CSPs have invested in developing data lakes and in software to enable sophisticated analytics. However, this is a challenging area. According to a recent TM Forum survey, while more than half of CSP/Tier 1 respondents said they believe data lakes are a good approach to storing data, about a third said that it was difficult to extract useful insights in an appropriate format and in a timely way. Faced with this, many CSPs are struggling to become customer-centric across the entire customer lifecycle, due to operations that are rigidly structured around siloed, on-premises systems, data and processes.

Uncoordinated data

For example, billing information often does not extend beyond the billing function of a CSP, network fault reporting does not extend beyond the CSP’s network services organisation, and information on the range of services sold to the customer stays in the sales department. Each of these interactions with the customer is most often completely disconnected, and the CSP then holds only fragmented views of its customers through uncoordinated data silos.

The cohesive, interconnected and integrated approach to customer experience is often called Customer 360, which describes how a 360-degree view of the customer is created and maintained. However, this concept is often aimed for but seldom accomplished.

While CSPs have a strategic aspiration to be ‘customer-centric’ the reality is that they are bogged down with legacy systems and constraints. It is seemingly impossible for them to really put the customer at the centre of everything and design processes and journeys around the customer because they have to compromise and fit into what the legacy systems allow them to practically do. Digital transformation for many CSPs really means recreating inefficient processes and journeys in a digital but still fragmented way, rather than actually transforming how they do business.

The concept of a customer-level 360 view is, again, aspirational. However, joining the dots between the different stacks is extremely difficult when businesses have grown by M&A over a number of years. This is especially true in multi-play CSPs and some leading CSPs can have more than 40 billing systems alone. The challenge here lies in how to tie all of that together to enable a 360- degree view of the customer?

Consumers do not want disjointed experiences across their fixed/mobile phone, broadband, cloud storage, email and streamed services. Customer-centric businesses will win because they can interact with consumers in a mirror image of how consumers interact with them – holistically, building the relationship over an extended period. As customers have begun experiencing more consistent, personalised treatment from providers in other industries, it is natural for them to expect – and demand – the same from their CSP. As part of this, it is essential to understand customers well enough to provide them with precisely what they need, when they need it. The best firms can then rise a level beyond that by anticipating what their customers will need in the future and taking preemptive action to provide that.

A decision-first approach

While it is all very well to have vast amounts of customer data available, it is by no means a panacea. In a so-called data-first approach, the focus is on collecting, managing and analysing data, then mining that data to find real business value. Yet finding that business value needle in the haystack of data demands more than simply harvesting and processing more data . That alone will not improve performance. A customer engagement that starts with the data itself will constrain results by first asking “what customer data do we have?”. It may be that the really valuable initiative requires data that is either not currently being collected or is being collected in a form that currently makes it difficult to extract or even unusable.

In contrast, a decision-first approach focuses on the business outcomes required and the value that provides for the customer and the company. It is aimed at improving organisational decision-making and goes far beyond business rules to model the structure of the decision-making process. The advantage of a decision-first approach can be viewed in terms of customer engagement: it is the decision not the data that is closest to the customer and what they understand. Once the challenges that need to be solved and the objectives that need to be reached have been decided, a Decision Management suite such as that offered by FICO can then define what is needed to get there.

There is enormous opportunity for Tier 1 CSP innovation in this area. How often does a CSP manage to combine its network data with its CRM data to gain a more holistic view of its customers? What could it do with that if it had it? Network data can provide information on where you are. Could that be combined with CRM data to get an idea of what you like or what you are doing – with privacy issues respected? Could CSP and perhaps fintech or retail data be used together to proactively offer new services that are relevant to location and personalised, in a way that individual customers will value?

Taking the use case of onboarding a new customer, for a CSP this often requires a form of credit assessment. But what if the assessment shows that there is too much risk in providing the customer with what they are asking for? Turning away a potential customer is an expensive decision because of the marketing budget that has already been spent in getting them to apply. What if they could instead be offered something close to what they want in the form of an alternative package that better fits their risk profile, thereby achieving a less risky sale for the CSP and a more affordable price for the customer?

An additional benefit to CSPs here is that the origination conversation and data gathering can be combined with fraud detection. There are distinct things you learn and discover about a customer in real-time through the onboarding process that could be used and honed to make sure the customer – and business – is better protected from fraud throughout their buyer’s journey. Further parameters could be proactively gathered and matured through the fraud protection journey as well.

Decision management is designed to support such decisions made while in discussion in real-time with the customer. It may involve choosing between hundreds or even thousands of alternative packages for that one individual customer. How easy is it to make such credit decisions quickly to suit the customer while also complying with the risk appetite of the CSP?

In another situation, the use case might be associated with in-life customer management or customer retention. A CSP knows intimately where you are all day long and, in many ways, could probably work out what you’re doing, so there is an opportunity to use this real-time data. Very few CSPs are really using streaming data generated from how their customers use services to understand context and determine actions based on that. For example, can streaming data be analysed so we can make an educated guess that someone has just moved address based on their location at specific times of day, and can we then recommend broadband, fixed line and TV services?

Another example would be to assess whether a customer might exceed their data allowance from their current usage and automatically switch them to a more appropriate plan that reduces the overage charges in a way that keeps customer satisfaction high and doesn’t cannibalise revenue.

CSPs can use streaming data to identify what can be learned from a customer’s behaviour that may help predict potential payment difficulties in the future and feed the insight and learning loop detailed in Figure 2. Should such a situation arise, the CSP can identify what could then be offered to address that. There may be, for example, an opportunity to cross sell, up sell or even down sell if that makes it possible to keep a valuable customer.

Then again, a further required decision might be around the question “which customers should I invest in to minimise the chances of them going to a competitor,” as referred to earlier in point (b) above. Once the decision required is recognised, it unlocks the potential for working back from that to understand the tools, analytical methods and data sources appropriate to tackle it from within the decision process.

Delivering the value: digital decision platforms

Enterprises everywhere are investing in machine learning and other AI capabilities, spurred on by the need to fend off disruptors or, better yet, outmanoeuvre them through self-disrupting innovation. Another motivator is the hope that artificial intelligence (AI) will increase return on investments previously made in big data infrastructures and data science. But while machine learning can discover many new insights from the interplay of different kinds of data, it cannot convert them into actions that create business value. For that, a digital decision platform is needed. This is a proven platform technology and processes with roots in robotic process automation (RPA) in the industrial sector, also referred to as cognitive automation by KPMG in the financial sector, or more generally decision automation.

Figure 3 outlines the combination of technologies that are increasingly being used to automate these business processes, operations and analysis. This ranges from robotics on rules-based processes, including basic optical character recognition (OCR) and screen scraping, through to the application of sophisticated, intelligent automation involving cognitive machine processing and elements of AI. These technologies sit on top of existing IT architecture components and in their most advanced form can interpret data from multiple sources to make decisions.

Digital decisioning platforms are a new segment that brings together four existing capabilities, often with optimisation capability:

- Business process automation

- Business rules management

- Predictive analytics

- Application development

For platform developers, digital decisioning is a new way to slice the market. While for users, one benefit is that it eases integration of predictive models into the production environment. Platforms offer a way to re-use common software elements across different activities and use cases and are therefore a rapid and lower cost route to implementation compared with a customised approach. In this way, they can quickly provide an overlay to existing systems that is both scalable and able to ingest multiple new data sources with minimum reliance on internal IT or a vendor.

According to Forrester Research, “a key challenge of digital business is deciding what to do in the customer’s moment of need – and then doing it. Digital Decisioning software capitalises on analytical insights and machine learning models about customers and business operations to automate actions… for individual customers through the right channel.”

Organisations using data analytics to constantly reconsider their options and decision management to operationalise new strategies are now achieving very large gains. The following results from across industries are typical examples:

- 30% increase in new customer bookings in one year

- 40% increase in sales with 35% increase in profitability per account

- 15% increase in on-time flight performance along with $39 million reduction in operating costs

- 4-second response time, down from 20 minutes

- 50% policy contract automation, up from 5%

The age of the customer

Customers are beginning to feel the difference. While becoming customer-centric has been a goal of businesses for years, only recently, with increasing adoption of decision management platforms, are a significant number of companies actually doing it. It is the difference between a 360-degree view as a concept and actually acting like you know who the customer is and what they are trying to accomplish, no matter which interaction channel they are using.

Another way customers are experiencing the difference is better choices. In this era Forrester has dubbed the ’Age of the Customer,’ product stock keeping units (SKUs) are exploding in numbers as businesses rush to meet customer demand for choice. Buying a mobile phone has, for instance, become increasingly complicated, with a plethora of decisions customers need to make about devices, options, accessories, service plans, support and financing. Piling more and more onto the menu can add to confusion rather than a better customer experience or higher satisfaction with the choices made. It can lead to decision fatigue, poor choices and discomfort with the whole experience. The truth is, as consumers, we do not want to work hard to find what we want. Though largely unaware of this preference, most of us want the work done for us. In that case, decision management helps, with streamlined ways to bring an individual’s attention to the best choices specifically for them. This in itself is more likely to lead to greater trust in the brand that delivers this.

FICO Decision Management

FICO has been helping businesses make smarter decisions for decades. The company pioneered AI- and machine learning (ML)- powered technologies and the decision management technologies to deploy these. FICO works with the world’s largest businesses, across telecoms, financial services, insurance, retail, government, energy sectors and more. It has deep expertise in delivering these platforms and helping transform business operations across all parts of the customer lifecycle, including customer onboarding, customer management, loyalty and retention.

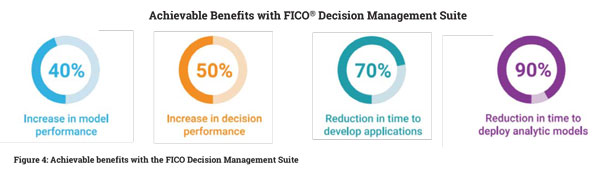

Available in the cloud or on-premises, the FICO Decision Management Platform connects data, advanced analytics, strategies and other decision components within one high-performance, scalable management and execution environment to deliver the achievable benefits shown in Figure 4. It provides the means to share decision assets across the enterprise, rapidly consume, develop and operationalise advanced analytics, and continuously track and improve operational results. It has been deployed in a wide range of industries, including Tier 1 network CSPs.

As part of its ‘New Wave’ assessment of Digital Decision Platforms, Forrester identified and reviewed 11 vendors including FICO, as shown in Figure 5.

Forrester measured 10 key decisioning platform attributes, with FICO receiving the highest ranking in 6 of these – Develop experience, Decision management features, Analytics features, Business results correlation, Vision and Market approach. According to Forrester “FICO leads with world-class decision management and analytics” and “FICO is best for companies automating consequential business decisions”.

FICO’s Telecommunications Expertise

FICO has been working with CSPs across the globe to help them apply their data to achieve business goals. Examples include FICO providing marketing pre-screening services for one of North America’s leading wireless providers. This prescreen is tied to the CSP’s credit originations system and ensures that new customers receive credit-appropriate offers. It is a unique solution within the US telecoms industry where more than 300 million potential customer records – the entire United States population – are assessed. Thus, whenever a prospective customer presents themselves to the carrier online or in-store, the carrier has a ready set of offers and services that they know the credit check will be approved for.

In Europe, a tier 1 UK mobile provider uses FICO’s decision platform to manage the credit risk of their existing customer portfolio, to make ongoing re-assessments of changes in their customers’ financial circumstances. This brings together customer records across multiple brands and legacy technology stacks, creating a single, consolidated decisioning platform. It enables the credit risk and sales and marketing teams to choose better-informed customer level strategies in selecting candidates for cross-sell and up-sell offers. Furthermore, being able to identify changing financial circumstances facilitates a proactive approach to debt management, reducing payment delinquencies, account suspension and churn.

Finally, FICO’s optimisation solution is being used to streamline customer acquisition at a major North American CSP. This project involves a CSP with more than 50 million subscribers and is detailed in full in the case study on page 16 of this issue of Tech Trends.

Summary

CSPs face considerable market challenges that can be addressed by a more personalised approach to their customers. There are many opportunities to innovate in this area, to introduce new services that customers will find valuable, increase the opportunity for direct contact to learn more about individual customer needs and to build trust in the CSP brand. Digital Decision Platforms provide a means for achieving this quickly and accurately without the need to build custom solutions from scratch. FICO has been recognised by Forrester Research as a world leader in this area.